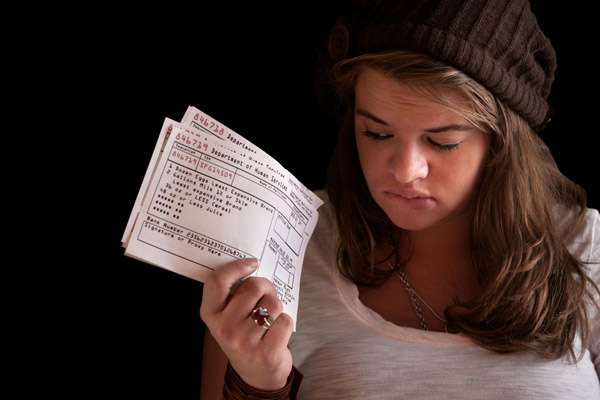

Who is this article for? If your spending most of your money paying bills this applies to you. If bills are eating up more than half your income, statistically this means you are unable to save money and might be impacted hard by an emergency.

Don’t worry, you are not alone. Increasingly, people are living paycheck to paycheck. The good news is that this sort of deficit can be temporary for the ones who find help at the right time.

The government runs several bill relief programs that can help low income families deal with mounting bill payments. These bill relief programs can help pay for phone bills, medical bills and other everyday expenses some families would be unable to pay on their own.

Help Paying Phone Bill with Lifeline

Lifeline is a phone bill assistance program operated by the federal government. It was established in 1985 and is currently administered by the Federal Communications Commission, or FCC.

This program was designed to help low income households gain access to affordable phones and phone service. Eligible families can participate in the program by creating an account with an approved provider, which often also awards free cell phones to families who need it most.

To qualify for Lifeline, households must meet the requirements set by the FCC. The first requirement is related to income, and establishes that only families whose income is at or below 135 percent of the federal poverty line can participate in the program.

For example, to qualify for the program, a family of three must earn less than $22,000 each year. Some states have raised the bar to compensate for higher costs of living. There, the threshold can be as high as 175 percent of the federal poverty line. Interested families should contact a local Lifeline-approved carrier to inquire about income requirements.

Second, households must participate in at least one financial assistance program run by the federal government. This includes Medicaid, Medicare, Supplemental Security Income, and Supplemental Nutrition Assistance Program, among others.

However, not all federal assistance programs are valid. In general, only those that provide some form of monetary subsidy are accepted by Lifeline carriers. Families should consult their local company to see which programs are accepted.

Members of tribes can sidestep this requirement, as most states categorize such populations as automatically eligible for Lifeline coverage. Some Lifeline carriers even offer special tribal packages that are designed to best address their needs.

Veterans that receive any form of special benefit are also automatically eligible for a Lifeline account. Citizens with severe disabilities, such as those with combined vision and hearing loss, can seek help from the National Deaf-Blind Equipment Distribution Program to get their Lifeline account set up and receive special cell phones.

Help Paying Energy Bill with LIHEAP

The average household spends around $1,000 on electricity bills each year. This can be a significant amount of money when income is scarce or when people become unemployed. To help low income families facing this problem, federal the government has created the Low-Income Home Energy Assistance Program, also known as LIHEAP.

Through this program, households receive subsidies to cover the cost of cooling and heating bills. The program also provides protection if an emergency happens, such as during utility shutoffs. In some cases, recipients can also use the subsidy to pay for low-cost home improvements, or weatherization, that reduce energy spending.

Eligibility for LIHEAP is determined by each state, but some requirements are consistent across state lines. For example, households who are enrolled in other financial assistance programs such as Medicare or the Supplemental Nutrition Assistance Program are automatically eligible for LIHEAP benefits.

However, the amount of money available through this program is finite and awarded on a first come, first served basis. Once funds run out, households would have to wait until the following year to gain access to the subsidies. State legislators often pass emergency bills that extend funding for the program when they consider it necessary.

Families must keep in mind that in most cases LIHEAP will only cover a part of their energy bills. Some households are also only subsidized for a particular type of energy, such as heating or electricity, but not both. Interested parties should contact their local office to know which type of coverage is available and how much money will they save.

Help Paying Medical Bills with CHIP and Medicaid

Most families are living one medical bill away from financial hardship. As a result, finding help covering medical expenses is a priority for families struggling to get by. Luckily, the federal government operates several assistance programs that help those who need it most. Together, these programs offer much-needed subsidies to more than 60 million people who would otherwise not have access to quality healthcare.

Medicaid and Medicare are the largest healthcare assistance programs run by the government. They offer subsidies to most low income families, senior citizens and disabled people. Families with young children can enhance their coverage through the Children’s Health Insurance Program, or CHIP. This program was created in 1997 to give children health insurance in cases where they would not have access to it.

State and local governments also run several assistance programs that complement the subsidies families receive. Among them are prescription medication aid, which helps people who cannot pay for medication; rental assistance, which can cover a portion or all rental bills of families depending on their condition; and mortgage assistance, which helps families refinance their mortgages to obtain lower interest rates and monthly payments.

Households can visit their local social security office to find out which programs are available in their area. Also, looking for cheaper health insurance policies is always a good idea. Most plans go up in price after a few years, reducing their affordability. When that happens, searching for a new one is the right step to make.

Websites like HealthCare.gov, a government-sponsored health insurance marketplace, offer affordable plans for people who are not eligible for Medicare or whose employer does not provide healthcare. The marketplace is also available to self-employed citizens and people looking for a better option than the one provided by their employer.

The cost of living has been rising in the last few years, pushing many low income households to search for solutions. The federal programs mentioned above are only one way families can obtain assistance to cover basic expenses, and possibly find a way out of financial hardship.

Although each program alone may not seem to help that much, together they can make a difference, saving families thousands of dollars each year.